Insurance Technology Diary

Episode 50: Learning Curve Ball

Guillaume Bonnissent’s Insurance Technology Diary

I began my career in underwriting the way most people do: by shadowing senior people who knew what they were doing. From those ‘seasoned professionals’ I learned all the basics, and quite a bit more.

I also learned by doing the rote work they were happy to hand off to a green newcomer. After a few days of pure observation, I was assigned various tasks involving the initial analysis of risks proposed by brokers (that is, reading long documents armed with a highlighter pen), fiddling with spreadsheets, and other mundanities.

I sifted through the mounds of documents that came with each submission to isolate the pertinent information. I learned box-ticking, compiling, table-making, and other essential skills as I went. Finally (sometimes after much midnight-oil burning) I would present my findings to the people who knew what they were doing. Eventually I was even asked to propose ratings.

For the business, this approach has dual benefits. First, much of the drudge work involved in risk analysis was handed over to me, an inexpensive, enthusiastic, and non-complaining performer.

Second, I was taking the first steps towards becoming one of the people who knows what they are doing. My employment as an underwriting assistant was, in all but name, my time as a trainee. By the time I was promoted, I had seen it all (at least, I thought I had).

It’s sexy to be a mentor in our market now, but overseeing the newbies day to day is a task which for many underwriters is both a time-consuming chore and a necessary investment in talent. Typically, the starters are quite quickly able to do straightforward tasks, freeing up the people who know what they are doing to focus on bigger pictures, larger risks, and longer lunches.

AI can now provide those same services. It is super at parsing and collating, comparing and compiling, tabulating and templating. AI is fast, and usually very accurate. Better yet, it costs a lot less than an underwriting assistant.

I have little doubt that AI today is better at any of the entry-level activities I performed back in the day. I required more input from the people who know what they’re doing, and was certainly slower (despite my modest perfectionist streak).

I saw an infographic last week from Visual Capitalist headlined ‘Human vs AI: Time to Complete Tasks’. It provides an answer to an increasingly common question: can machines do it faster and better than people? You won’t need me (or Claude) to tell you that the vector picture provides a partial and potentially misleading answer (1,000 words might be better).

According to the graphic, “writing” tasks that take a person 80 minutes can be completed in 25 minutes with generative AI (presumably, the time it takes to write the prompt). For “mathematics,” the duration is pared down from 108 minutes to 29. Other, super-surprising examples of amazing Gen AI efficiency versus people include:

- ‘Management of Personnel’ (103 minutes to half an hour).

- ‘Critical thinking’ (102 to 27).

- ‘Active learning’ (76 to 26).

- ‘Instructing’ (93 to 31).

I have selected these because I cannot imagine that Claude could do them for me. How does your Gen AI replace you in ‘active learning’? Does AI ‘personnel management’ involve the automated compilation and delivery of performance feedback?

I am practising reductio ad absurdum, of course, but only to make my point (finally). Machines, including AI, can do some of what humans can do, and sometimes they can do it faster, but they’re not yet ready to take over from the senior underwriters. They will always be needed, because in specialty, every risk is different.

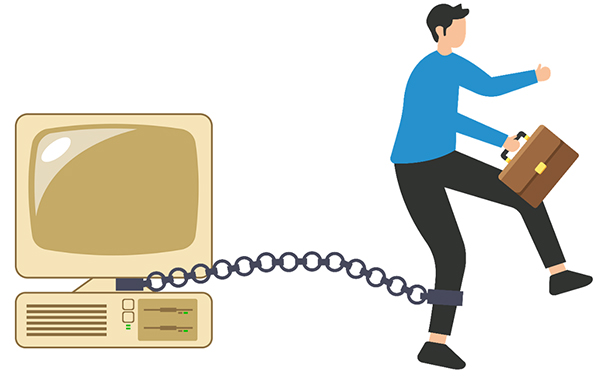

AI is great at making experienced underwriters more efficient at their job, but if we give all the underwriting assistant work to AIs, who will fill the underwriters’ shoes? How will the newbies gain the experience they need if the analytical jobs are taken away from them, and handed to machines?

We’re not the only industry facing this dilemma. There’s a parallel in the world of consulting. A friend who works for a giant consulting firm told me that their graduate intake went from 200 to 20 this year. Why? AI is doing the work they used to give to juniors.

Underwriters: you can stop worrying about AI taking your job. Instead, worry that it will force you to stay in post forever. Embrace AI – but don’t let it spoil your retirement plans. Save some of the boring stuff for human intelligences.