Insurance Technology Diary

Episode 34: Say what??

Guillaume Bonnissent’s Insurance Technology Diary

“That’s sick, papa,” my son said to me the other day. I thought I’d been reprimanded. When I asked what was nauseating about my demonstration of a bit of swag I’d picked up in an insurance conference (a cool flashlight), he said “No! Sick means it’s good!”

I get it. “Sick” means “cool”. It’s hard to keep up. A few years ago, I had to understand that when my other, older son said “it’s pants”, that also means “it’s cool” (unless it is modified slightly, and he says, “oh, that’s a bit pants”, which means “it’s poor”).

I like to think I speak English pretty well (as fluently as a native speaker, I’m told), but I’m still baffled by some words – contranyms – that mean opposite things depending on the context (like ‘pants’ when my son says it). In insurance, we have ‘sanction’, which can mean a prohibition on something, or an approval. We also have ‘oversight’, which is a lot different when you’re providing oversight than when you’re unknowingly making one. Go figure.

Then there’s simple cultural non-comprehension. When I first moved to the UK, I once held the door open for someone. They replied “Cheers!”, which confused the hell out of me.

Our business is notoriously ram-packed with jargon. Even without the devilish three-letter acronyms (TLAs) which almost no one can keep up with, terms used in one class of business can seem like Klingon to people just across the corridor. “Liabs” (pronounced ‘libes’) confused a colleague recently, until I explained it means “liabilities”. Everyone except D&O underwriters thinks ‘B Side’ is just a bad track on the back of a 45.

Other terms are unique to the sector, and mean nothing elsewhere (‘cedant’). Nor do the short-forms of elsewhere-meaningless terms (‘retro’). Another oddment I like is ‘specie’, which apparently comes from Latin, although I am not certain about the origin of specie.

(Sorry about that.)

Have you ever noticed the number of ways we use the word ‘risk’? It’s numbing: the insured thing and the thing that threatens it. As proxy for premium, but also for capital. It’s mighty confusing, even to initiates.

The international nature of business in London can also present enormous challenges of comprehension. An old colleague in property once proudly told me that he never writes French business because “all the policies have franchise”. I had to point out un faux ami: in French, ‘franchise’ means ‘deductible’. (Similarly, ‘sinistre’ can be bad, but it’s not evil.)

Insurance technology also has a dedicated London-market lingo. LIDS and PoSH have nothing to do with girl-groups. Even the most tech-fluent geeks won’t know what those are* unless they’ve worked in insurance in the Square Mile.

So what’s the moral of the story? You need an IT provider that speaks insurance, because nuance is lost in translation. And they need to speak the local dialect, too. Class by class, market by market, we have vocabularies.

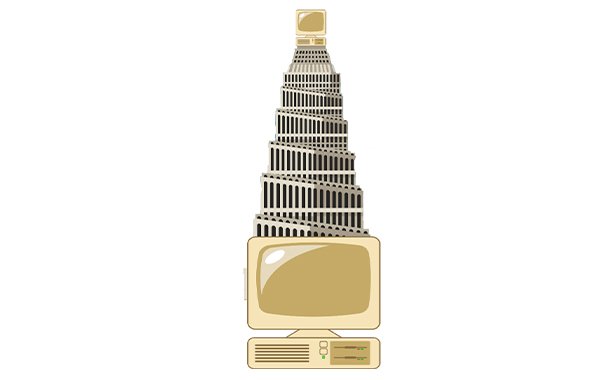

It’s important because, more often than not, if you don’t know the word ‘fac’, you don’t know what it is. If that’s you, when the client says “We need the platform to handle fac”, you have a very steep learning curve ahead, and not long to ascend.

But if you’re the buyer, and your IT provider already knows the jargon, chances are the code behind the functionality built to meet your spec will work very much more smoothly, n’est pas?

* Lloyd’s Insurance Data System and Policy Signing History.